Robinhood's Q3 Triumph: A Glimpse into the Democratized Financial Future We Were Promised

Okay, folks, buckle up. Robinhood just dropped its Q3 numbers, and they’re not just good—they’re a neon sign pointing towards the future of finance. We're talking about a company that, not so long ago, was synonymous with meme stocks and, let's be honest, a bit of chaos. Now? Now they’re not just playing the game; they're changing the rules.

They smashed expectations, pulling in $1.27 billion in revenue against an expected $1.19 billion. Earnings per share clocked in at 61 cents, blowing past the predicted 53 cents. But the real story here isn't just about the numbers; it's about what those numbers represent: a fundamental shift in who gets to participate in the wealth-building game.

Robinhood's Evolution: From Meme Stocks to Main Street

Remember the GameStop saga? It feels like a lifetime ago, doesn't it? Back then, Robinhood was seen by some as a facilitator of risky behavior, a Wild West for amateur traders. But what if that "risk" was actually just access? What if giving everyday people the tools to invest wasn't reckless, but revolutionary?

The narrative is shifting, and Robinhood’s Q3 results prove it. They're not just a platform for trading; they're building a comprehensive wealth management ecosystem. Think about it: they're aggressively courting clients from traditional giants like Fidelity and Schwab with deposit matches. And the TradePMR acquisition? That's not just a smart business move; it's a statement: "We're here to stay, and we're playing for keeps."

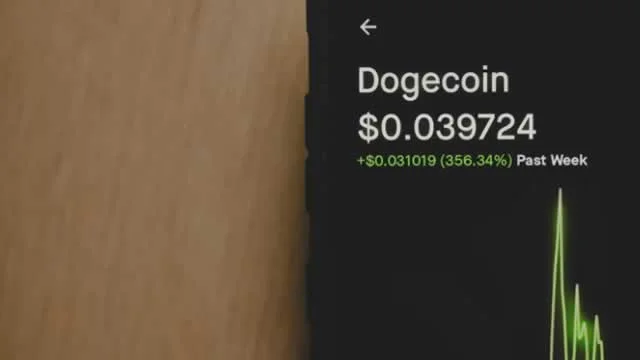

Finance chief Jason Warnick mentioned the addition of Prediction Markets and Bitstamp, adding approximately $100 million or more in annualized revenues. This kind of diversification is key, but what does it really mean? It means Robinhood is becoming more than just a brokerage; it’s evolving into a one-stop shop for all things finance, from crypto to traditional investments, all under one (user-friendly) roof.

This reminds me of the early days of the internet. Remember when people said it was just a fad? Remember when "online" was seen as somehow less legitimate than "real life?" We know how that story ended. And I suspect we're seeing a similar transformation happen in the world of finance. This isn't just about making money; it's about democratizing access to wealth creation. What happens when more people have a stake in the system? What kind of innovation will that unlock?

And let's not forget the human element. When I see these kinds of numbers, I don't just see dollar signs; I see families building a better future, entrepreneurs funding their dreams, and individuals taking control of their financial destinies. That's the power of democratization, and that's what gets me truly excited about this.

Of course, with great power comes great responsibility. As Robinhood continues to grow and evolve, it's crucial that they prioritize user education and responsible investing practices. We need to make sure that everyone has the tools and knowledge they need to make informed decisions. It's not enough to just open the doors; we need to make sure everyone can walk through them safely.

So, What's the Real Story Here?

Robinhood's Q3 triumph isn't just a win for the company; it's a win for the future of finance. As Robinhood doubles revenue as it beats third-quarter earnings expectations, it's a sign that the old guard is finally starting to make way for a new generation of investors, a generation that demands access, transparency, and control. This is just the beginning, folks. The financial landscape is changing, and I, for one, can't wait to see what happens next.